Warren Buffett believes that the return that a company gets on its equity is one of the most important factors in making successful stock investments. Return on capital is also important in finding out how well a company is doing.

Contents

Defining equity

Benjamin Graham defines stockholders equity as:

The interest of the stockholders in a company as measured by the capital and surplus.

Calculating owner’s equity

Investors can think of stockholders equity like this. An investor who buys a business for $100,000 has an equity of $100,000 in that investment. This sum represents the total capital provided by the investor.

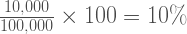

If the investor then makes a net profit each year from the business of $10,000, the return on equity is 10%:

If however the investor has borrowed $50,000 from a bank and pays an annual amount of interest to the bank of $3500, the calculations change. The total capital in the business remains at $100,000 but the equity in the business (the capital provided by the investor) is now only $50,000 ($100,000 - $50,000).

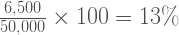

The profit figures also change. The net profit now is only $6500 ($10,000 - $3,500).

The return on capital (total capital employed, equity plus debt) remains at 10%. The return on equity is different and higher. It is now 13%:

The approach to financing its operations by a company can obviously affect the returns on equity shown by that company.

Why Warren Buffett thinks that return on equity is important

Just as a 10% return on a business is, all other things being equal, better than a 5% return, so too with corporate rates of returns on equity. Also, a higher return on equity means that surplus funds can be invested to improve business operations without the owners of the business (stockholders) having to invest more capital. It also means that there is less need to borrow.

What rate of return on equity does Warren Buffett look for?

This is a fluctuating requirement. The benchmarks are the return on prime quality bonds and the average rate of returns of companies in the market. In 1981, Buffett identified the average rate of return on equity of American companies at 11%, so an intelligent investor would like more than that, substantially more, preferably. Bond rates change, so the long-term average bond rate must be considered, when viewing a long-term investment.

In 1972, Buffett implied that a rate of return on equity of at least 14% was desirable. Although, at times, Warren Buffett has appeared to downplay the importance of Return on Equity, he constantly refers to a high rate of return as a basic investment principle.

Company rates of return on equity

It is significant that the majority of companies in the Berkshire Hathaway portfolio in 2012 had higher than average returns on equity over a ten-year period. For example, the average return on equity for Coca Cola from 2002 to 2011 was 30.38. The lowest ROE in that period was 27.1 in 2011 and the highest was 38.1 in 2010. If you take any of the companies in which Berkshire has major holdings (detailed in Buffett’s 2012 letter to shareholders) and then extract the figures from the information provided by ADVFN, you can compare and analyze the returns on equity that each of these businesses have maintained over the years.

There can be dangers in averaging returns over a long period. A company might start with high rates which then fall away, but still have a healthy average. Conversely, a company might be going in the opposite direction. As Warren Buffett looks for predictability in a company’s earnings, one would imagine that he would favor companies which increase their ROE or which have consistent levels.

Company annual rates of return

Compare the annual rates of return on equity of the following companies. We have used summary figures provided by ADVFN.

| Year | Coca Cola | Amazon | Wal-Mart Stores |

| 2002 | 33.7 | 0 | 19.0 |

| 2003 | 30.8 | 0 | 20.4 |

| 2004 | 30.3 | 0 | 20.3 |

| 2005 | 29.6 | 135.4 | 20.8 |

| 2006 | 30.8 | 44.1 | 21.1 |

| 2007 | 27.5 | 39.8 | 19.8 |

| 2008 | 28.4 | 24.1 | 19.9 |

| 2009 | 27.5 | 17.2 | 20.3 |

| 2010 | 38.1 | 16.8 | 21.1 |

| 2011 | 27.1 | 8.1 | 23.3 |

It is difficult to predict the future earnings of a corporation but the task becomes easier where a company shows a consistent earning power over a period of time. Looking at the tables above, one would feel more confident about predicting the future earnings of Coca Cola and Walmart than those of Amazon. Guess which of these three companies Buffett has not invested in?

You can do this exercise yourself. Choose a company or companies that interest you. Go to the ADVFN website and extract the relevant figures for the period of time on which you are focusing. Compare the returns on equity and examine them for consistency. (You can read about how to register for free on ADVFN here.)

Return on capital is very important

The example early on this page shows that debt financing can be used to increase the rate of return on equity. This can be misleading and also problematical if interest rates rise or fall. Another measure of the ability of company management to earn profits is the percentage of return on capital. This is the rate of return on all the money available to the company - shareholder equity and the proceeds of loans.

As you can see from the example above, if a company has no debt, then the return on equity is the same as the return on capital. If the company uses borrowed funds, the return on equity will be higher than the return on capital. The amount that the return on equity exceeds the return on capital increases as the debt becomes higher.

This is probably one reason why Warren Buffett prefers companies with little or no debt. The rate of return on equity is a true one and future earnings are less unpredictable. A careful investor like Buffett would always take rates of return on total capital into account as well as return on equity to get the true picture of how the company is going.

Over the years from 2002 to 2011, the average return on equity for Coca Cola was 30.38 and the average return on capital was 25.42. Over the same period the average return on equity for Amazon was 28.55 and the average return on capital was 13.78.A comparison of the rates of return on equity and capital for these companies is significant and readers can make their own calculations.