Contents

Warren Buffett does not like debt

Warren Buffett does not like debt and does not like to invest in companies that have too much debt, particularly long-term debt. With long-term debt, increases in interest rates can drastically affect company profits and make future cash flows less predictable. In the worst case, debt that can not be repaid can send a company into bankruptcy.

In 1982, Warren Buffett noted that Berkshire Hathaway preferred to buy companies with little or no debt and has repeated this mantra on many occasions. He adopts the same philosophy for his company, preferring to avoid debt but where necessary going into it with fixed rates of interest and to obtain the finance before they need it.

However, Buffett does use borrowed monies in a way. He uses the ”float” - monies paid to Berkshire Hathaway as premiums on insurance policies as funds for investment, a normal and proper practice of insurance companies. The premiums are held against possible future claims but until then are available for investment. This gives Buffett a cheap flow of finance.

What Warren Buffett says about debt

Warren Buffet acknowledges that debt can effectively increase the return on equity (leverage) in a company but warns against it.

Leverage works like this. If you buy a share for $100 and pay cash and it pays a yearly dividend of $10, your rate of return is 10 per cent, that is 10 times 100 divided by $100. If however you borrow $50 at an interest rate of 5 per cent and use that to buy the share, you are only putting in $50 of your own money. Of course, you must pay interest on the loan of $2.50 (5 per cent of $50) and this comes out of the dividend that you receive. So you net $7.50 ($10 dividend less $2.50 interest). Your net return in percentage terms has now increased to 15 per cent (7.50 times 100 divided by 50).

Using leverage to invest in an asset that produces a return, whether it be shares, property, manufactured goods, or provision of services, can therefore increase your rate of return and many businesses and investors do this. The higher the amount borrowed, the greater the return. The problem comes if and when the income from the producing asset falls, or reduces; in either case, you still have to pay the interest. Here leverage works in reverse. Further problems can arise where the lender has the power to increase the interest rate.

It is for these reasons that Buffett is wary about companies that incur debt without an exit plan or where it will take too long to repay. It is also why, when Berkshire Hathaway borrows money, it prefers to do so at interest rates that cannot be changed. Buffett thinks that it is best to avoid excessive debt obligations and says:

Good business or investment decisions will eventually produce quite satisfactory economic results, with no aid from leverage. It seems to us both foolish and improper to risk what is important (including, necessarily, the welfare of innocent bystanders such as policyholders and employees) for some extra returns that are relatively unimportant.

Benjamin Graham on Debt

There are various approaches to looking at a company’s debt. Benjamin Graham, in The Interpretation of Financial Statements, defined some important terms:

Current assets - Assets which either are cash or can be readily turned into cash or will be converted into cash fairly rapidly in the normal course of business. These include cash, cash equivalents, receivables due within one year and inventories.

Current liabilities - Recognized claims against the enterprise which are considered to be payable within one year.

Shareholders’ equity - The interest of the stockholders in a company as measured by the capital and surplus.

The current ratio or the liquidity test

Benjamin Graham believed that the current ratio, the ratio of current liabilities to current assets, was important in looking at a company’s financial position. In theory, the higher the ratio, the more comfortable, financially, is the company. This has been called the test of liquidity. Benjamin Graham said this about the current ratio:

When a company is in a sound position, the current assets well exceed the current liabilities, indicating that the company will have no difficulty in taking care of its current debts as they mature. There are several reservations here:

- A company with too high a ratio may not be using its surplus funds wisely

- Cash businesses, such as supermarkets, generally require a lower ratio than businesses that have protracted periods for customer payments.

Again, Benjamin Graham:

What constitutes a satisfactory current ratio varies to some extent with the line of business …

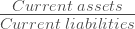

In industrial companies a current ratio of 2 to 1 has been considered a sort of standard minimum. David Hey-Cunningham believes that a reasonable rule of thumb measure is 1.5 to 1. The formula is:

For example, the 2012/12 balance sheet of Johnson and Johnson, a large Berkshire holding, discloses current assets at $54.316 billion and current liabilities at $22.811 billion. If we divide the current assets by the current liabilities, we get a current ratio of 2.38, a healthy result. (Buffett has recently reduced his shareholding in J and J).

You can calculate these ratios yourself or financial information services like ADVFN will do it for you for free.

The Quick Ratio

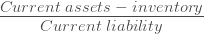

Benjamin Graham also looked at the Quick Ratio, a similar calculation but excluding inventory. Again, the size of the ratio will depend upon the business: companies with inventories that can readily be converted into cash probably do not need as high a ratio as those with longer-term inventories. But it was important to Benjamin Graham:

In every case, however, the situation must be looked into with some care to make sure that the company is really in a comfortable current position.

The formula is:

Using Johnson and Johnson again as an example, their balance sheet discloses the value of the inventory at $1.206 billion. Deducting this figure from the current assets ($54.316 billion) gives us a figure of $53.11 billion. Now divide 53.11 by the current liabilities (22.811) to get the Quick Ratio and the answer is 2.32, even healthier. We can conclude from this that J and J are extremely efficient in stock handling. David Hey-Cunningham (Financial Statements Demystified![]() 2006) writes about the acid test, which uses the same ratio as above, but does not include any bank overdraft in current liabilities.

2006) writes about the acid test, which uses the same ratio as above, but does not include any bank overdraft in current liabilities.

Debt to equity ratios

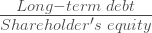

This shows the proportion of debt to shareholders’ equity. Debt can be either the total debt or more commonly long-term debt. David Hey-Cunningham gives the rule of thumb test as 0.5 to 1. The formula is generally quoted as:

Again, take Johnson and Johnson. The balance sheet we are using tells us that the long term debt is $12.969 billion and the shareholders’equity is $58.080 billion. Divide the long term debt by the shareholder equity and the answer is 0.23, well below the desired ratio.

Warren Buffett and long-term debt

Warren Buffett speaks only generally of his approach to debt. Mary Buffett and David Clark have concluded that he focuses on long-term debt, a conclusion that is supported by his public comments. They believe that his concern lies with the company’s ability to repay its debts, should the need arise, from its profits; the longer the time period, the more vulnerable is the company to external changes and the less predictable are its future earnings. to calculate the number of years, it will take a company to pay out the debt, you divide the total amount of long term debt by the profit amount.

In our continuing example, Johnson and Johnson have disclosed that their long term debt is $12.969 billion and their reported profit is $13.775 billion. To get the number of years it would take for the company to pay out its present debt from present profits, we divide the amount of the debt by the amount of the profit: .95 of a year. Not very long and very doable.

A prudent investor would always take into consideration both the long term debt (Buffett) and the current ratio (Graham).

Buffett on the US national debt

To some extent. Buffett applies the same principles when he considers the problem America is facing with its national debt. In a reported interview, he said that it was not the size of the debt that should cause concern but the ratio of the national debt to the gross national product (GNP). This defines the ability of a country to pay its debts: the higher the ratio, the more difficult it becomes and vice versa. In effect, he is applying a similar benchmark to sovereign debt as he does to a company in which he might invest - it is not the amount of the debt, but how quickly and realistic it is to pay the debt out of income. He is hopeful however, pointing out that America has a lower debt to GNP ratio than at other times in its history (about 100% now compared to 109% after World War 2), but the economy needs to grow to minimize the problem because if the debt remains the same, higher earnings means a quicker theoretical repayment time.